October 2022

Like other countries, the UK is experiencing high levels of inflation. Central banks are trying to control inflation by raising interest rates aggressively. The combination of inflation and rising interest rates has caused bond yields to rise substantially, and hence bond prices to fall sharply, since the beginning of the year in almost all major economies.

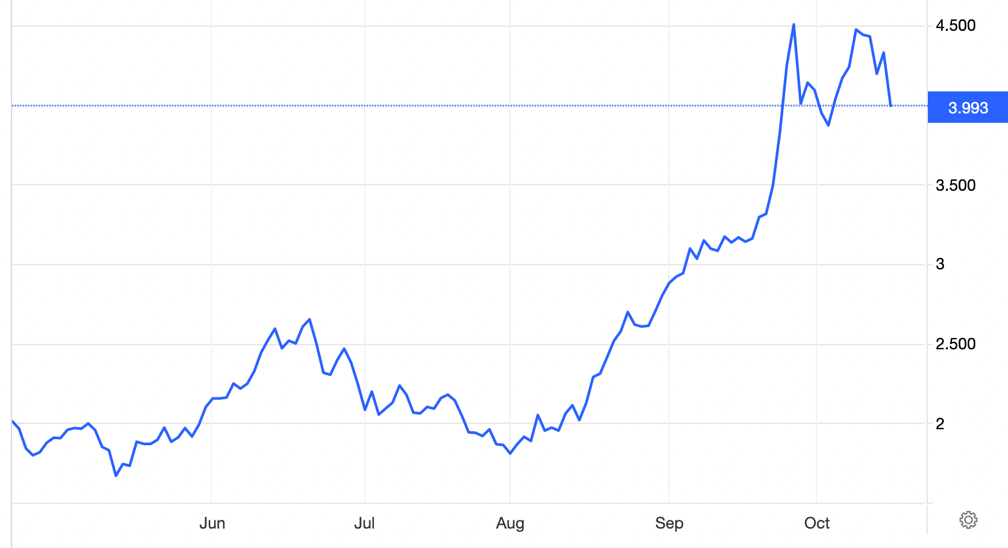

At the end of September, the new, but now already ex-, Chancellor announced a raft of tax cuts which appeared to be unfunded and would therefore need to be paid for by yet more government bond borrowing. Deciding that fiscal discipline had been abandoned, the gilt market went into a tailspin and yields on 10-year gilts soared from 3.5% to 4.5% in just five days.

Three weeks ago, few people outside the world of defined benefit pensions had heard of Liability Driven Investments (“LDIs”). These are investment strategies used in many final salary pension funds for the purpose of protecting pension payments in the future from adverse moves in inflation and interest rates. By utilising derivative contracts, some of which may include leverage to provide that protection, a pension fund has more capital to deploy in higher return-seeking asset classes. The pension fund, though, must make good any losses that may arise from its investments in those derivative contracts.

As prices of conventional and index-linked bonds plummeted after September’s mini-Budget, losses on those derivative investments spiralled and pension funds were therefore forced to sell gilts to meet their liabilities. Fearing a fire-sale, the Bank of England stepped in to stabilise the gilt market, promising to buy up to £5bn of gilts per day for a 13-day period.

This action was initially very successful and gilt prices rallied sharply. However, as the end of the intervention period on Friday 14th October drew closer, prices began to seesaw violently once again.

UK 10 Year Gilt Yields over the last 6 Months

Source: Trading Economics. Data as at Monday 17th October 2022

The period of intervention by the Bank of England has now ended. Whilst the Bank wants to avoid further disorderly turmoil in the gilt market, which could have far-reaching consequences such as in the mortgage market, it would be inappropriate for it to act as an ongoing backstop to pension funds which have engaged in investment strategies which could be termed ‘risky’. The clear message was that pension funds should put their own houses in order.

This has been a fast moving and alarming episode. Mr Kwarteng has been brutally sacrificed after just 38 days as Chancellor and his replacement Mr Hunt is cancelling almost all of the tax cuts announced by his predecessor. The short-term crisis within the gilt market should now be over and prices of gilts will now hopefully return to reflecting the outlook for inflation, interest rates and public finances in the UK instead of the largely self-inflicted woes of final salary pension funds.

In the portfolios we manage, we have been significantly underweight in exposure to gilts for some time and this has been beneficial to our performance, both in relative and absolute terms.